AML HQ empowers you to seamlessly Onboard more clients, faster. Perform your Client Due Diligence and Risk Screening for Know Your Customer checks all with our flexible online platform.

Complete AML solution for Accountants

AML HQ's all-in-one solution for accountancy service providers was created in line with guidance from competent authorities (CCAB-I, ACCA, CAI, CPA) to solve the challenges that accountants, bookkeepers, and tax advisers face in complying with ongoing Anti-Money Laundering regulations.

Our service reduces your risk of exposure to Money Laundering by guiding your staff through efficient processes such as initial Risk Assessments and Client Due Diligence checks. AML HQ reduces onboarding times and provides your clients with a modern, secure, and professional impression of your firm.

Our risk-based approach to Know Your Customer checks automatically creates the records and reports to demonstrate due process and compliance. All reports and evidence are automatically recorded in a GDPR-compliant process and can be efficiently retrieved on-demand to support audits and regulatory visits.

How we help Accountants

Onboard Customers Faster

Get the client’s AML file off the ground faster. Our onboarding tools allow you to instantly identify clients and meet your client due diligence obligations all in one place, streamlining your customer onboarding, and reducing time and costs for KYC checks.

Client Due Diligence for Accountancy Professionals

Identify clients remotely or in person using our online portal, so you always know who you are doing business with. From private to corporate clients, including beneficial owners have you covered.

Comply With AML Regulations

Show regulators that you take financial crime seriously and protect your business. Our complete compliance portal will provide you with the tools needed to meet your obligations.

Tailored Risk Assessments and Policy & Procedures

Identify clients and demonstrate due process. We provide risk assessments, policy and procedure documentation that you can use out of the box and edit to further tailor to suit your firm's needs.

Simple, Easy Workflow

Our templates and training modules can significantly ease the compliance burden placed on accountants while freeing up valuable resources within the firm to make the onboarding process smoother.

Always Audit Ready

Access to instant reports that provide audit-ready extracts and compliance gap analysis. All client data is stored safely in a secure and GDPR-compliant repository for access when audited.

Compliance Through Convenience

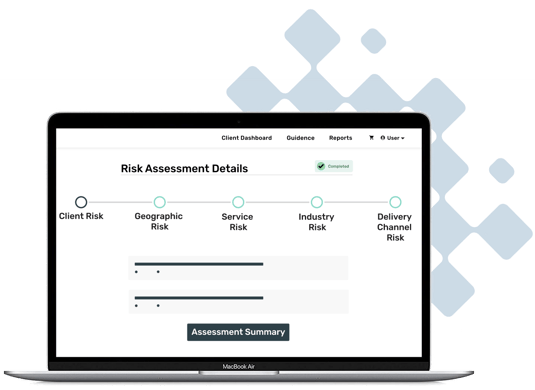

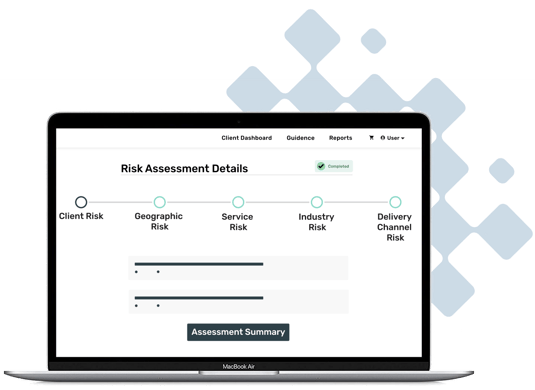

Creating a risk assessment is essential, but it doesn’t have to be difficult.

Anti-money laundering risk assessments are an essential part of preventing financial crimes and following regulatory mandates. Every practice must adopt a risk-based approach to AML, including having an AML risk assessment to keep your firm safe from money laundering and counter-terrorist financing.

AML HQ can quickly help you construct an effective risk assessment methodology that is cost-efficient and easy to implement. Our online risk assessment is designed to bring together every question you need in one easily editable document. The questions address risks collated from multiple sources.

A risk assessment helps to;

-

Assess the level of risk associated with their firm

-

Use a risk-based approach to prevent money laundering

-

Create robust policies, procedures, and controls that actively reduce the risk of financial crime

-

Make informed decisions about clients

-

Evaluate risk reduction measures

-

Identify transactions and relationships that involve an at-risk or sanctioned party

Tailored policies and procedures to suit your firm

Firms must establish and maintain a framework of policy controls and procedures to mitigate and manage the risks of money laundering. To identify, monitor, evaluate and manage the risks, the framework should be proportionate to the size and nature of the business.

AML HQ provides you with a full framework of policies, controls, and procedures that can be further tailored to your firms’ requirements. We will notify you with updated guidance from competent authorities across the UK and Ireland.

Our policies, controls and procedures cover every area of anti-money laundering compliance your firm might need to consider;

-

A risk-based approach, risk assessment, and management

-

Client due diligence

-

Record keeping

-

Internal control

-

Ongoing monitoring

-

Reporting procedures

-

Compliance management

Fast, simple and secure client due diligence

The purpose of client due diligence is to know and understand a client’s identity and business activities so that money laundering risk can be properly managed. Effective CDD, is therefore, a key AML defense. By knowing the identity of a client, including who owns and controls it, a business not only fulfills its legal and regulatory requirements, it equips itself to make informed decisions about the client’s standing and risk.

Our solution helps you onboard clients quickly and securely by using a combination of digital, physical, and biometric checks.

Our client due diligence process can be tailored to suit your needs and includes;

-

Official company information checks

-

Beneficial ownership verification

-

Document proof and data extraction

-

Biometric facial recognition

-

Liveness check includes video and motion capture

-

Configurable sanctions and PEP & screening

Compliant by design, make your audits as painless as possible

Audits often take up valuable resources within firms which end up costing time and money. AML HQ achieves compliance through convenience. Our automated processes help you work more efficiently whilst reducing friction points for you and your clients.

At any time you can run an instant firm-wide anti-money laundering compliance report. This is particularly useful to inform management on risk, allocate team resources or prepare for impending audits. At the touch of a button, our audit functionality allows you to produce comprehensive auditor extracts to evidence and demonstrate compliance.

Our tailored processes help you;

-

Assess compliance and achieve compliance assurance

-

Identify compliance gaps

-

Ensure CDD documentation and evidence are readily available for inspection

-

Review and respond to changes in your practice and legislation

CPD content tailored to fit the needs of your company's requirements

All professionals should receive continuing professional development (CPD) appropriate to their role. AML HQ provides you with the ability to track your staff’s training schedules and identify if there are any training gaps.

AML HQ provides access to a series of online CPD training webinar videos, on a variety of essential subjects and topics, available for purchase for accountants, solicitors or designated persons in a compliance role

Each CPD course gives you access to;

-

Virtual CPD conferences courses and webinars

-

Download all supplementary training documentation

-

Regular review and update

-

Documented record of all training maintained

Creating a risk assessment is essential, but it doesn’t have to be difficult.

Anti-money laundering risk assessments are an essential part of preventing financial crimes and following regulatory mandates. Every practice must adopt a risk-based approach to AML, including having an AML risk assessment to keep your firm safe from money laundering and counter-terrorist financing.

AML HQ can quickly help you construct an effective risk assessment methodology that is cost-efficient and easy to implement. Our online risk assessment is designed to bring together every question you need in one easily editable document. The questions address risks collated from multiple sources.

A risk assessment helps to;

-

Assess the level of risk associated with their firm

-

Use a risk-based approach to prevent money laundering

-

Create robust policies, procedures, and controls that actively reduce the risk of financial crime

-

Make informed decisions about clients

-

Evaluate risk reduction measures

-

Identify transactions and relationships that involve an at-risk or sanctioned party

Tailored policies and procedures to suit your firm

Firms must establish and maintain a framework of policy controls and procedures to mitigate and manage the risks of money laundering. To identify, monitor, evaluate and manage the risks, the framework should be proportionate to the size and nature of the business.

AML HQ provides you with a full framework of policies, controls, and procedures that can be further tailored to your firms’ requirements. We will notify you with updated guidance from competent authorities across the UK and Ireland.

Our policies, controls and procedures cover every area of anti-money laundering compliance your firm might need to consider;

-

A risk-based approach, risk assessment, and management

-

Client due diligence

-

Record keeping

-

Internal control

-

Ongoing monitoring

-

Reporting procedures

-

Compliance management

Fast, simple and secure client due diligence

The purpose of client due diligence is to know and understand a client’s identity and business activities so that money laundering risk can be properly managed. Effective CDD, is therefore, a key AML defense. By knowing the identity of a client, including who owns and controls it, a business not only fulfills its legal and regulatory requirements, it equips itself to make informed decisions about the client’s standing and risk.

Our solution helps you onboard clients quickly and securely by using a combination of digital, physical, and biometric checks.

Our client due diligence process can be tailored to suit your needs and includes;

-

Official company information checks

-

Beneficial ownership verification

-

Document proof and data extraction

-

Biometric facial recognition

-

Liveness check includes video and motion capture

-

Configurable sanctions and PEP & screening

Compliant by design, make your audits as painless as possible

Audits often take up valuable resources within firms which end up costing time and money. AML HQ achieves compliance through convenience. Our automated processes help you work more efficiently whilst reducing friction points for you and your clients.

At any time you can run an instant firm-wide anti-money laundering compliance report. This is particularly useful to inform management on risk, allocate team resources or prepare for impending audits. At the touch of a button, our audit functionality allows you to produce comprehensive auditor extracts to evidence and demonstrate compliance.

Our tailored processes help you;

-

Assess compliance and achieve compliance assurance

-

Identify compliance gaps

-

Ensure CDD documentation and evidence are readily available for inspection

-

Review and respond to changes in your practice and legislation

CPD content tailored to fit the needs of your company's requirements

All professionals should receive continuing professional development (CPD) appropriate to their role. AML HQ provides you with the ability to track your staff’s training schedules and identify if there are any training gaps.

AML HQ provides access to a series of online CPD training webinar videos, on a variety of essential subjects and topics, available for purchase for accountants, solicitors or designated persons in a compliance role

Each CPD course gives you access to;

-

Virtual CPD conferences courses and webinars

-

Download all supplementary training documentation

-

Regular review and update

-

Documented record of all training maintained

Testimonial

We at ProfitPal have always embraced technological solutions that drive efficiencies and delight customers. AML HQ is exactly the service we need to cover our Anti-Money Laundering obligations. AML HQ is easy to use, makes my team more efficient, and helps keep my business compliant. I am confident that our next ACCA audit will be a lot easier.”

Denis Breen, Managing Director of Profit Pal

Related Articles

FAQ

The Criminal Justice (Money Laundering and Terrorist Financing) Act 2010 (as amended) identifies particular persons that provide specific business activities in the state as “designated persons”. One such group of designated persons includes tax advisers or external accountants.

Section 24 of the Act defines external accountants as: “a person who by way of business provides accountancy services (other than when providing such services to the employer of the person) whether or not the person holds accountancy qualifications or is a member of a designated accountancy body.” Tax adviser is defined in the same section as: “a person who by way of business provides advice about the tax affairs of other persons.”

The Act place a number of legal obligations on designated persons to guard against them being used for the purpose of money laundering or terrorist financing. The key obligations are:

-

Customer Due Diligence (CDD) – Sections 33 to 39

-

Ongoing Monitoring – Section 35

-

Business Risk Assessment – Section 30A

-

Customer Risk Assessment – Section 30B

-

Policies and Procedures – Section 54

-

Record Keeping – Section 55

-

Suspicious Transaction Reporting (STR) – Section 42

At AML HQ we help Accountants to meet their AML requirements, our service reduces your risk of exposure to money laundering by guiding your staff through efficient processes such as initial risk assessments, client due diligence checks and providing PCP templates. Whether your prospective client is a body corporate or an individual, our all-in-one solution covers every base, so your business is protected when it comes to complying with the latest anti-money laundering regulations.

Guidance from the Association of Chartered Certified Accountants (ACCA) and the Anti-Money Laundering Guidance for Members of the Bodies affiliated to the Consultative Committee of Accountancy Bodies in Ireland (CCAB-I) define what Policies, Controls and Procedures are required for Accountants.

They maintain that every Accountancy firm must have appropriate policies and procedures for assessing and managing Money Laundering risks. They also refer to the Criminal Justice (Money Laundering and Terrorist Financing) Acts 2010 to 2021 which places certain requirements on Accountancy firms regarding Client Due Diligence CDD and ‘record keeping, procedures, and training'.

The following topics, all of which form part of the Money Laundering framework, need to be considered when drafting policies and procedures:

-

Risk Based Approach, Risk Assessment and Management.

-

Customer Due Diligence (CDD)

-

Confirm Beneficial Ownership

-

Record keeping

-

Internal Control

-

Ongoing Monitoring

-

Reporting Procedures

-

Compliance Management

-

Communication

-

Training and Awareness

Accountancy firms must implement and document policies, controls and procedures that are proportionate to the size and nature of the firm. These should be subject to regular review and update, and a written record of this exercise maintained.

AML HQ's all-in-one solution for accountancy service providers was created in line with guidance from competent authorities (CCAB-I, ACCA, CAI) to solve the challenges that accountants, bookkeepers, and tax advisers face in complying with ongoing anti-money laundering regulations.

We do this by providing you with:

-

Policies, controls, and procedures manual that you can use out of the box or you can further tailor to suit your firm.

-

Digital risk assessments that allow you to quickly determine risks and efficiently record assessments to evidence due process.

-

Client onboarding processes and tools to help you identify and verify new corporate clients and private individuals. AML HQ helps you to make a good first impression with new clients while also securely managing their sensitive data in accordance with GDPR.

-

Training material and electronic training logs to track and monitor your staff training requirements.

-

Audit reporting that significantly reduces the administrative burden when an AML audit is undertaken.

To stay compliant with evolving AML regulations, accountancy firms must adopt a proactive approach. This includes regular staff training, client due diligence, and effective risk management processes. AML HQ simplifies this by offering an all-in-one AML solution that helps firms meet their obligations efficiently.

Our service includes:

-

Digital risk assessments for firm-wide and client-specific risk management.

-

Client onboarding tools to identify and verify both corporate and individual clients, meeting CDD requirements.

-

AML policies, controls and procedure templates that can be tailored to your firm's needs.

-

Instant audit reports and compliance gap analysis for easy auditing.

-

Staff training hub to ensure your team stays up to date with AML requirements.

AML HQ helps streamline your processes and ensures your firm meets its AML obligations with ease.