AML HQ reduces the time and effort it takes to Onboard your clients, improving their experience and delivering the highest levels of regulatory compliance.

AML HQ's solution helps regulated entities in various industries with their Anti Money Laundering obligations. Such industries include banking, real estate, payments, insurance, investments, and credit unions.

Our solution allows you to streamline your compliance process and meet your Know Your Customer obligations through a risk-based approach and the application of proportionate due diligence. If you’re time-poor and would like to avoid the hassle of manual processes, our simplified workflows will quickly verify customer information from initial onboarding to ongoing customer due diligence.

We equip compliance teams with the tools and knowledge to tailor their Anti Money Laundering compliance process. Our user-friendly solution offers self-service capabilities and intelligent alerts for case management, audit review and CPD training.

Take the delay out of manual onboarding. Our solution completes individual and corporate searches in seconds, allowing you to verify your clients all in one place, streamlining customer onboarding and reducing time for KYC checks.

Always know who you are doing business with, from private to corporate clients including beneficial owners, we have you covered.

We retain Customer Due Diligence information and document the steps taken during your compliance process. You can access instant reports that provide audit-ready extracts and compliance gap analysis.

Reduce the need for manual checks with different providers and remove the need for data entry. Staff no longer risk inadvertently inputting errors or omitting key information. Our process is standardised with a series of checks which creates efficiency and reliability.

Our centralised solution provides a single, secure place to onboard clients quickly and easily, with no technical integration needed. Simply create your account and start adding clients.

Most firms don’t have large compliance teams and processes in place to abide by the regulations. AML HQ's platform is continuously updated to be in line with The Central Bank of Ireland, ensuring your firm meets continual KYC obligations easily, quickly and cost-effectively.

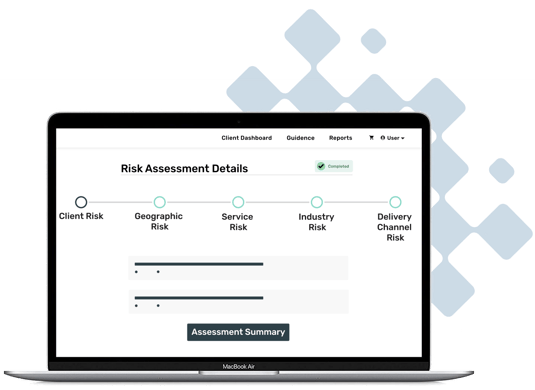

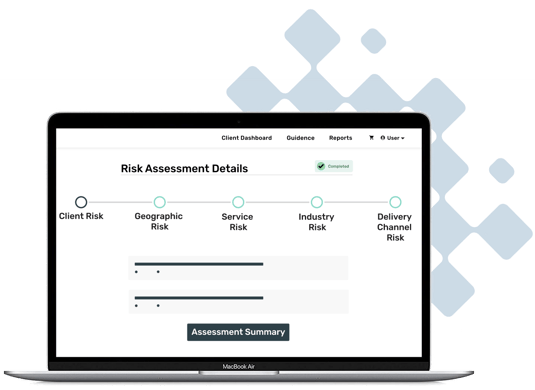

Anti-money laundering risk assessments are an essential part of preventing financial crimes and following regulatory mandates. Every practice must adopt a risk-based approach to AML, including having an AML risk assessment to keep your firm safe from money laundering and counter-terrorist financing.

AML HQ can quickly help you construct an effective risk assessment methodology that is cost-efficient and easy to implement. Our online risk assessment is designed to bring together every question you need in one easily editable document. The questions address risks collated from multiple sources.

A risk assessment helps to;

Firms must establish and maintain a framework of policy controls and procedures to mitigate and manage the risks of money laundering. To identify, monitor, evaluate and manage the risks, the framework should be proportionate to the size and nature of the business.

AML HQ provides you with a full framework of policies, controls, and procedures that can be further tailored to your firms’ requirements. We will notify you with updated guidance from competent authorities across the UK and Ireland.

Our policies, controls and procedures cover every area of anti-money laundering compliance your firm might need to consider;

The purpose of client due diligence is to know and understand a client’s identity and business activities so that money laundering risk can be properly managed. Effective CDD, is therefore, a key AML defense. By knowing the identity of a client, including who owns and controls it, a business not only fulfills its legal and regulatory requirements, it equips itself to make informed decisions about the client’s standing and risk.

Our solution helps you onboard clients quickly and securely by using a combination of digital, physical, and biometric checks.

Our client due diligence process can be tailored to suit your needs and includes;

Audits often take up valuable resources within firms which end up costing time and money. AML HQ achieves compliance through convenience. Our automated processes help you work more efficiently whilst reducing friction points for you and your clients.

At any time you can run an instant firm-wide anti-money laundering compliance report. This is particularly useful to inform management on risk, allocate team resources or prepare for impending audits. At the touch of a button, our audit functionality allows you to produce comprehensive auditor extracts to evidence and demonstrate compliance.

Our tailored processes help you;

All professionals should receive continuing professional development (CPD) appropriate to their role. AML HQ provides you with the ability to track your staff’s training schedules and identify if there are any training gaps.

AML HQ provides access to a series of online CPD training webinar videos, on a variety of essential subjects and topics, available for purchase for accountants, solicitors or designated persons in a compliance role

Each CPD course gives you access to;

Anti-money laundering risk assessments are an essential part of preventing financial crimes and following regulatory mandates. Every practice must adopt a risk-based approach to AML, including having an AML risk assessment to keep your firm safe from money laundering and counter-terrorist financing.

AML HQ can quickly help you construct an effective risk assessment methodology that is cost-efficient and easy to implement. Our online risk assessment is designed to bring together every question you need in one easily editable document. The questions address risks collated from multiple sources.

A risk assessment helps to;

Firms must establish and maintain a framework of policy controls and procedures to mitigate and manage the risks of money laundering. To identify, monitor, evaluate and manage the risks, the framework should be proportionate to the size and nature of the business.

AML HQ provides you with a full framework of policies, controls, and procedures that can be further tailored to your firms’ requirements. We will notify you with updated guidance from competent authorities across the UK and Ireland.

Our policies, controls and procedures cover every area of anti-money laundering compliance your firm might need to consider;

The purpose of client due diligence is to know and understand a client’s identity and business activities so that money laundering risk can be properly managed. Effective CDD, is therefore, a key AML defense. By knowing the identity of a client, including who owns and controls it, a business not only fulfills its legal and regulatory requirements, it equips itself to make informed decisions about the client’s standing and risk.

Our solution helps you onboard clients quickly and securely by using a combination of digital, physical, and biometric checks.

Our client due diligence process can be tailored to suit your needs and includes;

Audits often take up valuable resources within firms which end up costing time and money. AML HQ achieves compliance through convenience. Our automated processes help you work more efficiently whilst reducing friction points for you and your clients.

At any time you can run an instant firm-wide anti-money laundering compliance report. This is particularly useful to inform management on risk, allocate team resources or prepare for impending audits. At the touch of a button, our audit functionality allows you to produce comprehensive auditor extracts to evidence and demonstrate compliance.

Our tailored processes help you;

All professionals should receive continuing professional development (CPD) appropriate to their role. AML HQ provides you with the ability to track your staff’s training schedules and identify if there are any training gaps.

AML HQ provides access to a series of online CPD training webinar videos, on a variety of essential subjects and topics, available for purchase for accountants, solicitors or designated persons in a compliance role

Each CPD course gives you access to;

Just what we were looking for. A simple, intuitive, and affordable solution where we can manage all our Money Laundering obligations. Onboarding is now frictionless and painless for both the team and our clients.

Ken Keehan, CEO at DevCom Capital

The Criminal Justice (Money Laundering and Terrorist Financing) Act (CJA) is the primary piece of regulation in Ireland that covers Anti-Money Laundering (AML). Section 25 of the CJA states that the following are subject to AML regulation:

Credit Institutions

Financial Institutions

Auditors (External Accountants or Tax Advisors)

Relevant Independent Legal Professionals

Trust or Company Service Providers

Property Service Providers

Casinos

A risk-based approach (RBA) is having an understanding of the money laundering and terrorist financing risks they are potentially exposed to and mitigating those risks by applying anti-money laundering and counter-terrorist financing controls and measures. To adopt a risk-based approach is to:

recognise the existence of risk(s)

undertake an assessment of the risk(s)

develop strategies to manage and mitigate the identified risks

The difference between Client Due Diligence (CDD) and Enhanced Due Diligence (EDD) is the risk level of the client being onboarded. CDD must be conducted prior to entering a business relationship or prior to carrying out an occasional transaction or a service. If the client appears to be low risk, CDD is sufficient. However, if during the onboarding process the client appears to be a higher risk then EDD must be applied where additional checks must be sufficed before conducting business with them. A risk-based approach (RBA) is essential when determining if a client requires CDD or EDD.

Beneficial ownership, as defined in Article 3(6) of the 4th Anti-Money Laundering Directive (4AMLD), is any natural person or persons who ultimately own or control a legal entity. This can be either through direct or indirect ownership of a sufficient percentage of the shares or voting rights, such as:

Direct or indirect ownership of more than 25% of a company or societies shares or

Controlling directly or indirectly more than 25% of a company.

Or control via other means including:

Through a shareholders agreement,

The exercise of dominant influence or

The power to appoint senior management.